Coins are often seen as a way to conserve as well as increase capital. But which products are better to choose? Money from precious metals is divided into investment and numismatic. The latter include commemorative, collectible, jubilee, etc.

In terms of composition, articles can be single-component or contain several metals at once. Below we will deal with what are investment and numismatic coins, which are better to choose from.

About investment

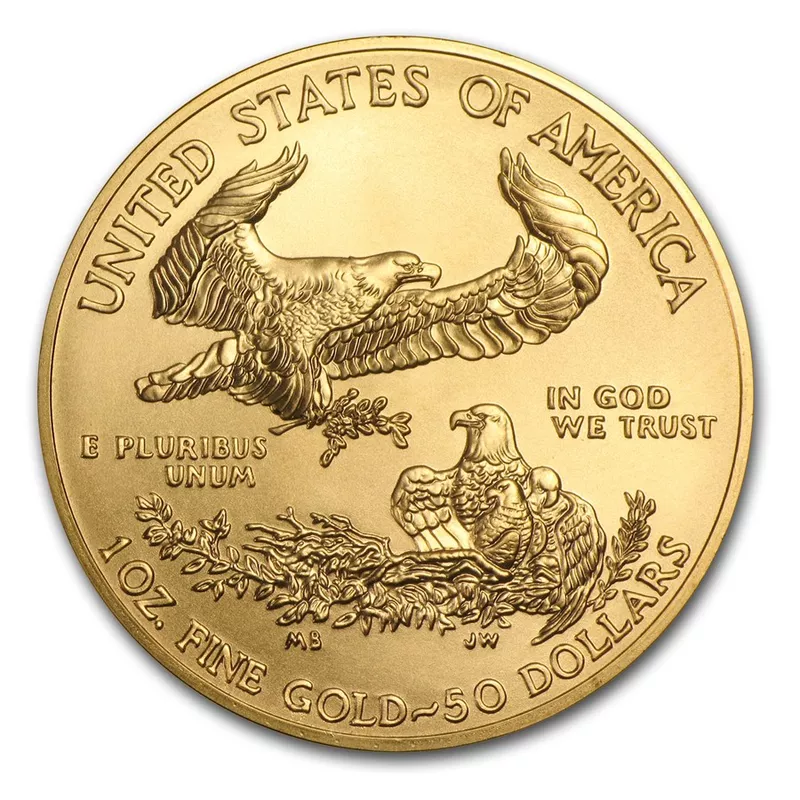

Let's compare investment products and numismatic ones. The main difference is the formation of prices. The cost of investment banknotes depends on the present price of the metal from which they are made. They do not represent artistic or memorable value. They are sold en masse, and they themselves do not have a mark-up for rarity. If you look at the dynamics of prices, it turns out that it will repeat the change in the quotes of the corresponding metal on the world market.

Investing in investment banknotes is almost always profitable. Gold, silver, as well as other precious metals, are slowly but confidently gaining in price. Investing money in them is less risky compared to investing in securities, currency, real estate. The purchase is not particularly difficult, does not take much time and does not require experience. All transactions take place quickly and simply, do not require immersion in nuances.

About numismatic

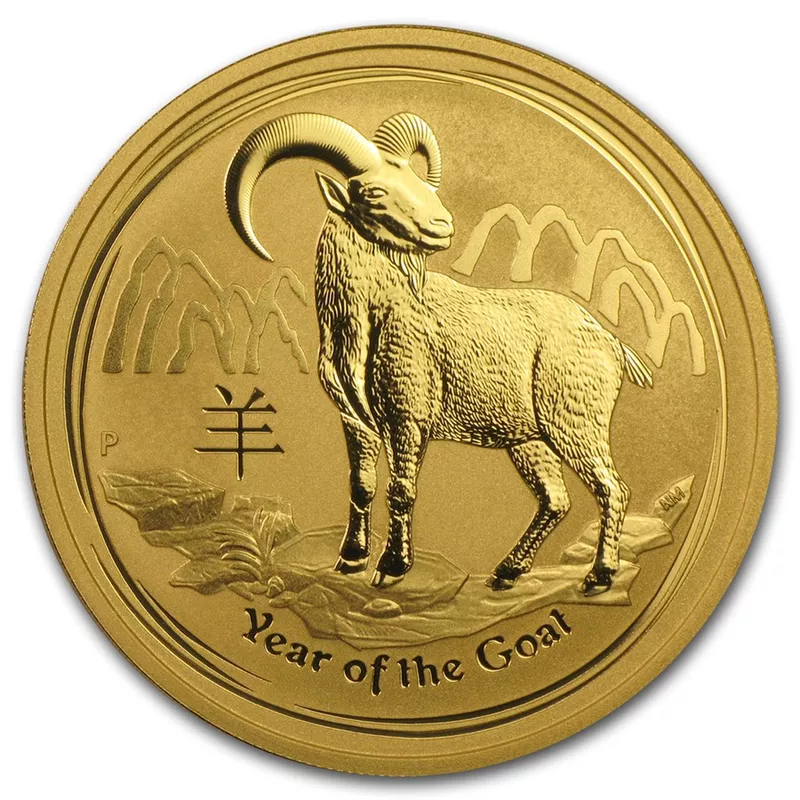

The cost of numismatic products does not depend on the real market quotes of precious metals. It is influenced by the artistic, memorable, as well as the collectible value of banknotes. That is why the real price is often above par. Such banknotes are issued in a limited number.

There is an opinion that numismatic coins are not suitable for investing money. That's not really the case. If you approach the matter responsibly, choose the right cash sign, then you can become the owner of a commemorative coin, and in the future it is profitable to resell it.

Features of investing money in numismatic coins

Markups on numismatic coins are always higher compared to investment coins. This is due to high quality, rarity, low circulation of banknotes. Often the owner of a rarity has to make a lot of efforts, spend time finding a buyer.

There is another nuance. It consists in the fact that if you buy commemorative products from banks, then when a crisis occurs, they can depreciate, and their value goes down to nominal. It is extremely difficult to give accurate forecasts here. That is why buying numismatic coins is always a risk.

Selling and buying investment coins is almost always easier than numismatic ones. Maple Leaf, Britannia and other famous banknotes can easily be sold in almost any state. Typically, the mark-up is about 7%.

Selling commemorative, collectible banknotes is likely to take more effort and time. However, if you find a buyer on them, you can get a double benefit. A commemorative coin made of precious metal, presented in excellent condition, can bring its seller considerable profit. The main thing is to find someone who is really interested in it.

Specialized places for selling coins, for example, the Kalita.Gold online store, will help with this. Here you can not only buy, but also sell valuable banknotes profitably. You can get more information about this from managers through the feedback form of our website.